Emmerson Mnangagwa, the new president of Zimbabwe, will have a hard time digging his country out of the economic hole that it fell into during the 37 years it was led by Robert Mugabe. But it can be done.

During Mr. Mugabe’s reign, all economic activity was dependent on political decisions, which enhanced the prizes of political power and the stakes in the fight for it. State-owned enterprises, capital controls, price controls, import controls, one-time mining fees and a plethora of regulations wrapped Zimbabwe in a giant ball of red tape and destroyed the economy.

Measured by real gross domestic product per capita, living standards are now only 78 percent of what they were when Mr. Mugabe assumed power in 1980. When one looks at agriculture, for instance, the erosion is clear. Zimbabwe used to export maize; now it is an importer. Since the land reforms of 2000, the value of farm production has shrunk by 45 percent.

Over the past two decades, Zimbabwe has been in a state of almost constant crisis. The once-prosperous nation now ranks among the poorest and most repressive countries in the world.

The fiscal picture is not a pretty one, either. Budget officials took to heart the sentiment behind Mr. Mugabe’s rhetorical question in 1997, “Have you ever heard of a country that collapsed because of borrowing?” Zimbabwe’s annual budget deficits averaged 5.4 percent of G.D.P. during Mr. Mugabe’s tenure, with the current deficit at a whopping 11.2 percent. The result is a mountain of bad debts and arrears.

The collapse shows up in every international rating of the economy. In the World Bank’s Doing Business 2018 index, Zimbabwe ranks 159 out of 190; in the Fraser and Cato Institutes’ Economic Freedom of the World listing for 2017, Zimbabwe is 144 out of 159; and in the World Economic Forum’s Global Competitiveness Index for 2017-2018, Zimbabwe ranks 124 out of 137.

When it comes to specific sectors, the picture is just as dismal: In the Fraser Institute”s Investment Attractiveness Index 2016 for mining, Zimbabwe ranks 96 out of 104.

[perfectpullquote align=”right” bordertop=”false” cite=”” link=”” color=”” class=”” size=””]On Nov. 14, 2008, the annual inflation rate peaked at 89.7 sextillion percent. Prices doubled every day, making Zimbabwe”s 100 trillion dollar notes worthless.[/perfectpullquote]

Zimbabwe”s economic decline has been punctuated by several notable events and episodes. One of these was the Fast-Track Land Reform Program of 2000, under which land was seized from white farmers.

This confiscation had been happening since 1980, but under this program, the farms were taken without compensation. Zimbabwe”s Supreme Court declared the program unconstitutional, but Mr. Mugabe”s government ignored that ruling.

This flagrant abuse of property rights and the rule of law sent the economy into a deep dive. From 2000 to 2008, real G.D.P. per capita contracted on average by 8.29 percent per year. During this period Zimbabwe ran large fiscal deficits financed by printing money and experienced the second most severe case of hyperinflation in history.

On Nov. 14, 2008, the annual inflation rate peaked at 89.7 sextillion percent. Prices doubled every day, making Zimbabwe”s 100 trillion dollar notes worthless. In the end, the government was forced to scrap the Zimbabwean dollar, because Zimbabweans simply refused to use it.

Mr. Mugabe’s government then instituted a system in which the United States dollar became the coin of the realm. Government accounts became denominated in United States dollars in 2009. As a result of this dollarization and the installation of a national unity government in 2009, the economy rebounded.

[perfectpullquote align=”right” bordertop=”false” cite=”” link=”” color=”” class=”” size=””]The World Bank has found that there is a strong positive relationship between a country’s prosperity and how easy it is to do business there. At present, Zimbabwe ranks 159 out of 190 on the bank’s ease of doing business metric, with a score of 48.47.[/perfectpullquote]

That rebound persisted during the term of the national unity government, which lasted till July 2013. During this period, real G.D.P. per capita surged at an average annual rate of 11.2 percent. The minister of finance, Tendai Biti, who was a member of the opposition, understood that under a dollarized regime, the country would no longer be able to print money to finance deficits. Consequently, budget deficits were almost eliminated.

With the collapse of the unity government and the return of Mr. Mugabe’s Zimbabwe African National Union-Patriotic Front party, old habits resurfaced. The fiscal deficit ballooned – something that should not happen under “dollarization rules.” But Mr. Mugabe would break any rule.

To finance its ballooning deficits, the government began to issue an enormous number of “New Zim dollars” in 2016. As night follows day, Zimbabwe experienced its second bout of hyperinflation in a decade.

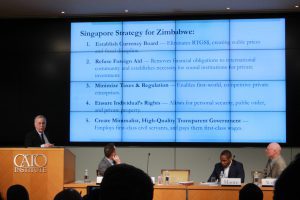

The end of Mr. Mugabe’s rule raises the question: What is next for the economy? Zimbabwe could adopt the strategy of Lee Kuan Yew, Singapore’s first prime minister. That strategy was based on four principles: stable money, no foreign aid, first-world competitiveness and the protection of private property and the public’s safety. With Mr. Lee’s near-perfect execution of the strategy, Singapore escaped its grinding poverty of 1965 to become one of the world’s most affluent countries.

“Singapore started with a currency board system—a simple, transparent, rule-driven monetary regime.” – Steve Hanke

Mr.Mnangagwa does not remind one of Mr. Lee. Indeed, he was a pillar of Mr. Mugabe’s regime. Unlike the impoverished populace, Mr. Mnangagwa and his supporters in the military and party have done well under Mr. Mugabe’s system of spoils.

But the people are fed up with their poverty. Mr. Mnangagwa claims to be listening, even declaring that the “voice of the people is the voice of God.”

To deliver, Mr. Mnangagwa must prohibit the issuance of New Zim dollars. The dollarization rules followed by the unity government should be restored. Mr. Mnangagwa should also announce that private enterprise is Zimbabwe’s future.

The World Bank has found that there is a strong positive relationship between a country’s prosperity and how easy it is to do business there. At present, Zimbabwe ranks 159 out of 190 on the bank’s ease of doing business metric, with a score of 48.47. If the country loosened the government’s grip on the economy and reached the same score as neighboring Botswana (64.94), it would boom, as it did during the unity government years.

The new president should establish a cabinet task force that would be responsible for making it easier to do business in Zimbabwe. It now takes 61 days and costs more than an average person’s annual income to start a business. When compared with those of other countries in the region, these costs are sky high. As a first reform step, the government should slash the biggest contributor to these costs: the licensing requirements and fees needed to start a business.

By adopting such a strategy, confidence and the economy would both soar. Zimbabwe’s G.D.P. per capita would reach the same level as Botswana’s current level in about 16 years. Zimbabweans’ level of income would then be almost six times its current level. Zimbabwe would once again be the “jewel of Africa.”

Steve Hanke is a professor of applied economics at Johns Hopkins University and a Senior Fellow at the Cato Institute.

First appeared in The New York Times on November 30, 2017.